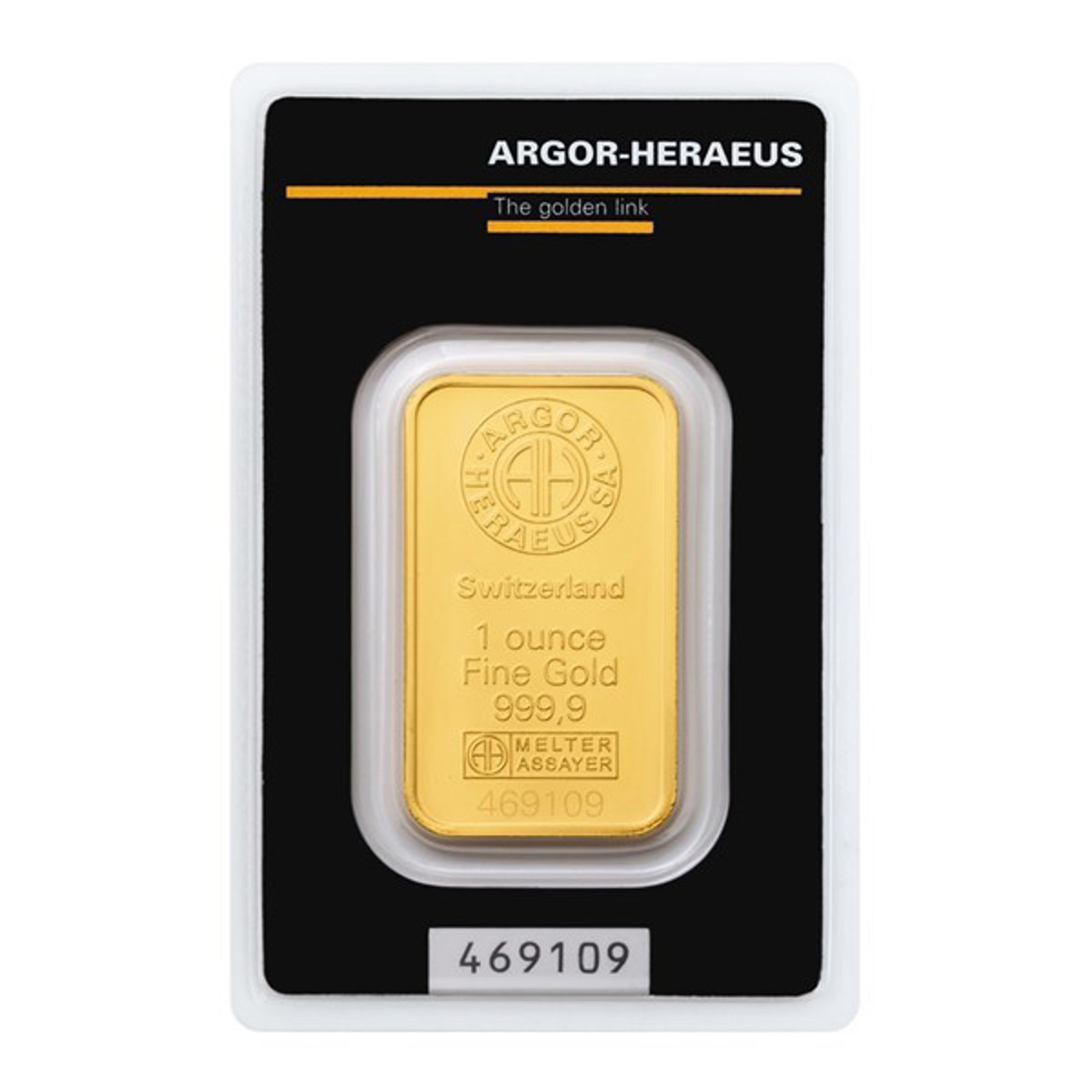

Best-selling products in the investment gold category

Gold price development

It is not known exactly when gold was discovered, nor when it began to act as an instrument of exchange. However, it was a symbol of power and wealth for centuries BC, and people were able to make an incredible effort to gain it. Besides the exceptional attributes of yellow metal, its rarity played a role. According to geological surveys, gold in the earth's crust is about nineteen times rarer than silver. Gold has been accepted as an indicator of value worldwide, therefore, it simplified trade. Although silver predominated in the Middle Ages, the world soon returned to gold which retained its monetary status until the 1930s and the end of the Bretton Woods monetary system in 1971. Gold ceased to be a currency, however, the investors did not forget it.

The main factors affecting the development of the price of gold on the stock exchange include the exchange rate of the US dollar (if the value of dollar decreases, the price of gold will rise), inflation (gold is an ideal insurance against rising prices and rising inflation causes higher demand for yellow metal, which leads to growth of its price) and the level of interest rates (if they decline the price of gold will increase). Gold is a commodity, so its price in the market responds to demand and offer, which is easily affected by global events. The price of gold has been significantly developed over the last 50 years. This is evident when looking at the graph of the long-term development of the price of gold - the uncertainty affected by the global crises caused investment madness and the price of gold soared in 1979 and 2008. The rapid increase in the price of gold also occurred during the coronavirus pandemic, which affected the world at the beginning of 2020. In this case, the demand for gold significantly exceeded the supply and a number of distributors reported sold out - even this information then contributed to the hunger for investment metal. Then in 2025, in response to escalating wars - both trade and military - the price of gold exceeded 3000 and then 4000 US dollars per troy ounce for the first time in history.

People turn to gold with confidence, especially in times when they fear the devaluation of their money.

What is the forecast for the development of the price of investment gold in the future? Gold is an volatile commodity - it is experiencing ups and downs, but investors can always rely on it. For anyone looking for security instead of speculation, it is an essential component of a balanced investment portfolio.

čeština

čeština

slovenčina

slovenčina

english

english